Let's start with the important question.

Why did Tesla drop the price of cars?

The answer is EV Credit is only available for Vehicle manufacturer's suggested retail price (MSRP) is less than:

What is EV The federal electric vehicle (EV) tax credit is a credit that can be claimed on your federal income taxes for buying or leasing an EV. The credit amount varies depending on the specific EV and the manufacturer. However, it is important to note that the credit begins to phase out for a manufacturer after they sell 200,000 electric vehicles, so the credit may not be available for all buyers. Make sure to check with Tesla to ensure you will indeed qualify for the tax credit of up to $7500.

To qualify for the credit, the EV must be new and manufactured in North America. Additionally, the EV must be primarily powered by an electric motor that draws electricity from a rechargeable battery.

Who Qualifies for this credit:

Your modified adjusted gross income (AGI) may not exceed:

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit. The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years.

The Section 179 Deduction is a tax incentive that allows businesses to deduct the full purchase price of qualifying property, such as cars, trucks, vans, and SUVs that weigh over 6,000 pounds, in the year they are placed in service. This can be a significant tax benefit for businesses that need to purchase vehicles for their operations.

Under Section 179, businesses can deduct the full cost of qualifying property, up to a certain dollar limit, from their taxable income in the year the property is placed in service. The dollar limit for the Section 179 Deduction is set by the government and can change from year to year. Additionally, there is a phase-out threshold, which means that the deduction is gradually reduced as the total cost of all the assets purchased in a year exceeds a certain amount. For 2023, the maximum amount of the Section 179 deduction is $1,160,000, and the phase-out is increased to a maximum of $2,890,000.

The Section 179 Deduction can be used to deduct the cost of new and used equipment, off-the-shelf software, and certain other qualifying property that is acquired and placed in service during the tax year.

It's important to note that the Section 179 Deduction is subject to certain limitations and restrictions. For example, the property must be used primarily for business purposes, and if a vehicle is used for personal use, the amount of the deduction may be limited. It's recommended to consult a tax professional to determine the specific details and qualifications for the deduction.

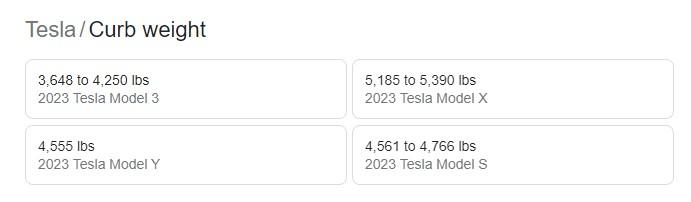

Find out the actual weight of your car. I did a quick google search to get an estimate.

Bonus Depreciation and Section 179 Deduction are both tax incentives that allow businesses to deduct the cost of qualifying property, such as cars, trucks, vans, and SUVs, in the year they are placed in service. However, there are some key differences between the two incentives:

Bonus Depreciation allows businesses to take an additional first-year depreciation deduction of 100% for qualified property. This means that businesses can deduct the full cost of the property in the year it is placed in service, in addition to any other depreciation deductions they may be eligible for. Bonus Depreciation applies to both new and used property.

Section 179 Deduction allows businesses to deduct the full purchase price of qualifying property, up to a certain dollar limit, in the year it is placed in service. The dollar limit for the Section 179 Deduction is set by the government and can change from year to year. Additionally, there is a phase-out threshold, which means that the deduction is gradually reduced as the total cost of all the assets purchased in a year exceeds a certain amount.

Bonus Depreciation is an additional first-year depreciation deduction of 100% while Section 179 Deduction allows businesses to deduct the full purchase price of qualifying property in the year it is placed in service. Both incentives can be used together, but the business should consult a tax professional to determine the specific details and qualifications for each deduction, and how they can maximize their tax benefits.